Focus

Ethan has been relentlessly focused on one mission—unifying fragmented digital experiences. He can’t stop thinking and acting on ways to connect the online world, guided by a single belief: The future isn’t more apps. It’s one aligned experience starting with finance, expanding everywhere.

““If people can conduct their transactions quickly and securely that’s better for them. If it’s simpler to conduct their financial life it’s better for them. So, if all your financial affairs are seamlessly integrated in one place it’s very easy to do transactions””

This quote carries an undercurrent of frustration from the early PayPal days, suggesting that the original X.com brand was better suited to complete the flywheel. The promise to complete the cycle remains largely unfulfilled by Big Tech. However, the goal remains unchanged: to offer users a centralized platform for all their needs with a streamlined, user-friendly interface. The "holy grail" is to create the best version of the U.S. Super App, simplifying this complex ecosystem.

How to think 10x Bigger when Creating the One True Super Platform

Let's develop a theory to address decentralized transaction issues, called the Unified Field of 8 (UF8). Here are the 8 key fields across the flywheel comprising this Unified Field Theory: Social (I), Education (II), Finance (III), Shopping (IV), Health (V), Mobility (VI), Location (VII) and Mini-Apps (VIII). The goal is to make transactions and various aspects of life more seamless and centralized with a simplified one-touch payment system across the fields. Achieving this requires imagination and a passion for thinking differently.

A key aspect of Super Apps in the US is that the leading companies are centered around specific themes. For instance, Google's theme revolves around Location (VII), while Uber's Super App focuses on Mobility (VI). Surrounding this central theme are business segments. Uber's strategy, for example, is straightforward—leveraging its strong market fit in transportation to cross-sell a variety of transport-related products, ultimately aiming to capture the entirety of its customers’ wallet share.

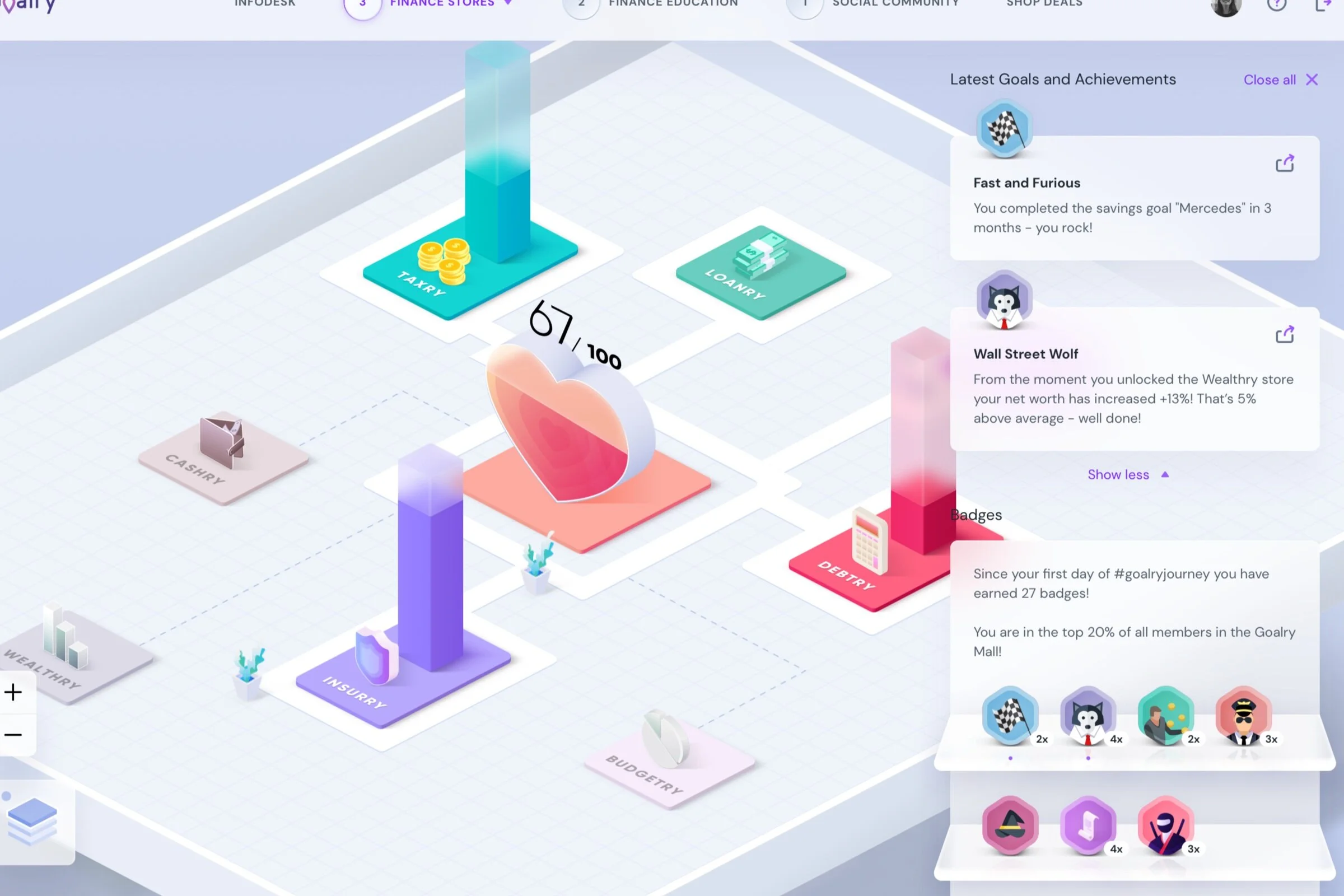

A new company called Goalry is centered around a shopping Super App theme, enhanced by AI-driven financial tools. The goal of this Super App with a shopping meets finance theme is to promote an array of sustainable retail-related products, incorporating savings, rewards, and even charity opportunities. The most important element is to reinvent the ecosystem to benefit both the planet and people, with the ultimate aim of capturing the full spending potential of its customers.

Beyond affordable and sustainable shopping, the design is spatially planned to be fun and engaging, with a 3D experience that immerses you in a gamified, interactive environment. Encompassing all aspects of one's life, it's a place you want to visit daily because it fosters good habits, gamifies rewards and achievements, and offers everything you need and want to buy, all in an engaging and visually stimulating virtual space.

As the UF8 matures, however, Goalry is uniquely designed to encompass multiple themes simultaneously. The fully developed Goalry UF8 is still several years if not decades away. For now, and as it evolves, the primary focus remains on integrating shopping with finance, particularly with a brand centered around a mall.

Relentlessly focused on integrating these 8 fields, Goalry turns this theory into practice with its next-gen model. The UF8 aims to elevate the more than 70% of consumers who live paycheck to paycheck to new levels, while enabling those who already prosper to achieve even more. It's designed for broad business participation that includes a full white-label solution. This cooperative approach with various industries allows countless companies to gain visibility and leverage new technologies for easier cross-adoption between the 8 fields. For Goalry, we start with Finance (III) and Shopping (IV), leveraging our award-winning design to uniquely expand into other areas over time.

The UF8 benefits the entire network, making it favorable across various industries, similar to how Kayak.com benefits the travel industry and how Amazon drives lower prices by consolidating logistics networks. When the financial and online worlds converge effectively, everyone stands to gain. Goalry is well beyond the blueprint stages.

It’s a commitment to think big—10x bigger, in fact—and tackle the challenge head-on.

Six Degrees of Freedom and the Digital Mall’s “Quantum Design”

While there are 8 fields of a true Super Platform’s services and features, the operating system design to house everything requires six degrees or what we call our “Quantum Design”. The concept of “Six Degrees of Freedom” is fundamental in various fields such as machinery, robotics, manufacturing, 3D modeling, video game design, vehicles, and even the human body. It describes how an object moves through 3D space, either by linear translation or axial rotation. Specifically, an object can move up/down, forward/back, and left/right, or rotate around three perpendicular axes: pitch, roll, and yaw. Degrees of Freedom can also be visualized as the faces of a six-sided die, where each face represents a different direction or dimension in which an object can move or vary, such as translation or rotation along the X, Y, and Z axes. Just as a die has six faces, a three-dimensional object can have up to Six Degrees of Freedom, encompassing all possible linear and rotational movements.

To pinpoint six degrees of freedom in the digital world, we examined offline structures that unify a lot of things in one place. We recognized that if a human-made physical structure could accommodate a vast amount of items, it could be limitless in the digital realm.

Based on common observation, a shopping mall is the perfect structure for this purpose. It also doesn’t require instructions; everyone knows how a mall works. It has a directory for easy navigation, an Infodesk that can be translated through AI with endless floors, stores, and experiences. A mall translates perfectly into the digital realm, providing unlimited space that feels immersive on any device. Hence, the Digital Mall was conceived to achieve six degrees of freedom. This unique design offers endless expansion possibilities, enhancing user engagement and interaction in a way that sets the Digital Mall apart from traditional platforms.

Unlike other sites/apps/platforms that are limited in degree rotation, the Digital Mall incorporates complete freedom for endless expansion across these six degrees:

Immersive Floors

Isometric Gaming Grid

Multiple Pull Up Feeds

Zones

Scroll Navigation

Traditional Menus

The Digital Mall’s “Quantum Design” leverages each degree to create an immersive, all-in-one solution for companies to embed their services and brand. By adopting a gamified approach for consumers, the Digital Mall automates an individuals progress towards goals on a customizable path with branded milestones and badges. This results in a super platform that seamlessly combines finance, social interaction, shopping, and much more into a delightful and expansive experience.

The importance of unifying social, education, finance, shopping and more from the front.

Anyone creating a Super App or Everything App needs to think beyond transactions, social media feeds and chat. Aligning backend payment gateways for efficient financial transactions requires a corresponding shift in the front-end experience. Despite advancements like cryptocurrency, decentralized banking issues persist, highlighting the need for a comprehensive solution that extends beyond backend improvements and enhances the front-end experience.

Onboarding is key, guiding users towards their initial intent—Whether it's shopping for a specific item or brand 🛍, managing debt 💳, building wealth 💰, or even expanding to include managing health-related activities 🧘🏻♀️ as the platform evolves. A single secure login, known as the "Member Key," streamlines the entire process. This Member Key also unifies third parties or companies with a unique locking and unlocking system embedded within location icons. It is brand-agnostic, as are the design colors, allowing any brand to become part of the Digital Mall and appear in the correct location based on a member's entry point, activity, or data profile. The location icon and Member Key are more than mere design elements; they are symbolic of the platform's philosophy, where every interaction, every journey through its virtual mall, is a step towards a more comprehensive and fulfilling commercial experience, tailored to enhance every aspect of personal wellness.

Upon closer inspection, the Member Key reveals a hidden element—a subtle yet significant detail that embodies the platform's commitment to tailored shopping experiences. This hidden feature is akin to the Amazon A to Z element, indicating that everything is available within the Digital Mall. It is a nod to the intricate and specific nature of commerce within the platform, illustrating how every aspect is carefully curated to cater to individual needs and preferences. After all, it is a mall and hence shopping is a central and natural element. Additionally, since financial transactions are at the core of the “Finance Floor” of the mall, real-time offers for savings can be sent to members. By monitoring daily activity, the platform can alert members to various cost-saving opportunities and promote healthy habits, which they can then one-click purchase on the “Shopping Floor” or at zones in the Digital Mall.

Here's an Example of the Power of just 1 of the 6 Degrees: "Floors”

We built a Digital Mall. One place to reach goals and comparison shop for any matter.

THE MALL HAS SEVERAL FLOORS AND STORES:

GOARLY.COM IS THE MAIN ENTRANCE TO THE MALL

HERE’S AN EXAMPLE OF JUST ONE OF THE “FLOORS” IN THE MALL WITH THE BELOW “STORES” FOR ALL THINGS FINANCE:

LOANRY.COM - Shop and compare loans

CASHRY.COM - Cash flow tools and emergency cash

BUDGETRY.COM - Budget tracker and planner

BILLRY.COM - Track spending and save on bills

CREDITRY.COM - Everything credit. Even scores

DEBTRY.COM - Debt payoff tracker and planner

WEALTHRY.COM - Investments, net worth and retirement builder

TAXRY.COM - Shop and compare tax offers

ACCURY.COM - Accurate value of real estate with an equity maximizer

INSURRY.COM- Shop and compare insurance

BLOCKRY.COM- That latest cryptocurrency Insights and tools to manage your wallet.

Mastering finance enables application across all verticals. The Digital Mall can integrate shopping, automate decisions with bank-level data, elevate gamification, and centralize with AI.

For any Super App to excel, it must be gamified with engaging rewards. Goalry does this by using an isometric gaming grid for a next-level rewards system. Users earn badges for achieving goals, creating a digital storybook of their accomplishments. These game-like elements keep users inspired, turning real-life achievements into digital rewards and forming chapters in a virtual vision board.

Spatial 3D Experiences

Utilizing the Six Degrees, the Digital Mall creates a unique gaming meets social media vide.

Digital rewards are key. Beyond cash back and free shipping, we plan to use digital currencies or tokens, increasing the tokens value and creating significant benefits for both individuals and the community. Members start with a wallet that can convert fiat into crypto, enabling peer-to-peer crypto payments and purchases within the mall, paving the way for a more efficient payment network. The Blockry Store (on the Finance Floor) houses the digital wallet as a single Web3 asset class, while the accounts zone connects to a vast network of 16,000 financial institutions, reaching over 200 million consumers to build the individuals entire financial profile. The best way to get people to allocate funds towards digital assets is to be where they manage the rest of their money. Of course, the natural progression for the accounts zone is to offer our own banking services, such as credit cards and insured deposits with interest.

Only when you’ve mastered the front end experience can AI be fully utilized

The AI drives interaction throughout the mall via the InfoDesk engine, enhancing user experience by providing personalized assistance, recommendations, and real-time support. This integration ensures that every visit to the mall is tailored to your preferences, making your shopping, finance, and learning experiences more efficient and enjoyable.

There are two layers to the Mall’s AI: one that "talks to your money" using vertical AI to analyze banking data, and a second focused on general experiences around your goals, such as education and planning. You are designing your vision board based on your desires, but also using AI to make informed decisions based on your budget.

Lastly, we plan to give a percent of our profits to curated charities, showcased on the member's storybook and badges path. This creates a charity contribution on a member’s profile at no cost to them, and they can also contribute more to their selected charities.

Background

In 2005, as VP at Acxiom, Ethan conceived the idea of unifying fields while working on the Yodlee account. His obsession with Bank of America's net worth tracking and its integration of external data fueled a persistent vision for a unified platform. This quest culminated in Goalry—a transformative journey beyond finance towards a better life through automation. Before Goalry, Ethan Taub spent a decade developing some of the world’s largest online marketing programs for global 100 enterprises and ran communities exceeding 600 sales professionals when he lived in the Silicon Valley. In 2008, Ethan became a C-level executive and invested seven figures in a patented platform that makes finances interactive. Later in 2013, he continued his track record of success by becoming the CMO for one of the nation’s largest lenders with over 2000 employees funding billions in loans each year.